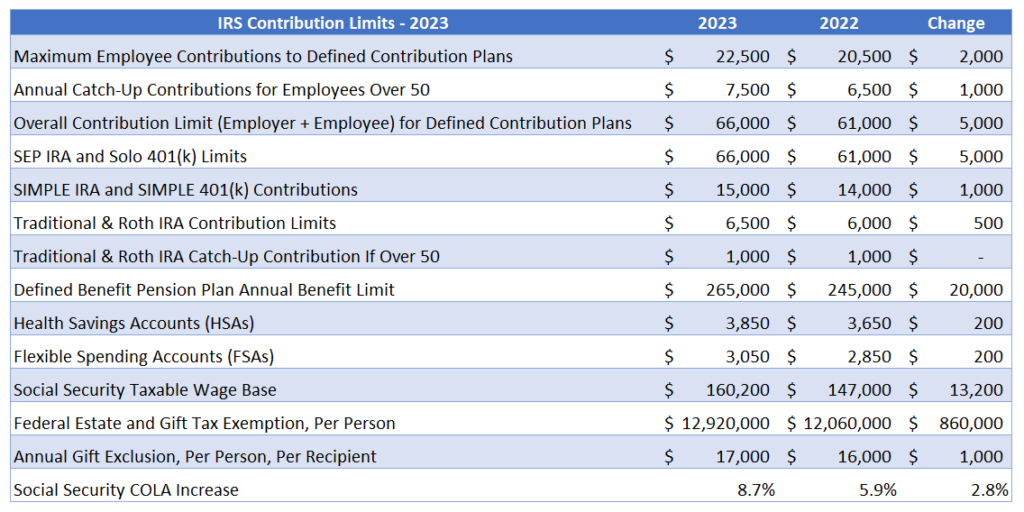

Irs Traditional Ira Income Limits 2024. The annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. Any deductible contributions and earnings you withdraw or that are distributed from your traditional ira are taxable.

The irs announced the 2024 ira contribution limits on november 1, 2023. The account or annuity must be.

Irs Traditional Ira Income Limits 2024 Images References :

Source: vitoriawferne.pages.dev

Source: vitoriawferne.pages.dev

Irs Limit 2024 Liuka Rosalynd, In 2024, you can contribute an additional $500 to either account.

Source: gwendolenwelnore.pages.dev

Source: gwendolenwelnore.pages.dev

Roth Ira Limit 2024 Ginger Mirabelle, For heads of household, the 2024 is.

Source: verilewbeulah.pages.dev

Source: verilewbeulah.pages.dev

Roth Ira Limits 2024 Irs Sukey Stacey, Unlike with a roth ira, there's no income limit for those who can contribute to a traditional ira.

Source: donicaqlaurel.pages.dev

Source: donicaqlaurel.pages.dev

Roth Ira Limits 2024 Irs Deena Othelia, If you have a traditional ira, a roth ira―or both―the maximum combined amount you may contribute annually across all your iras.

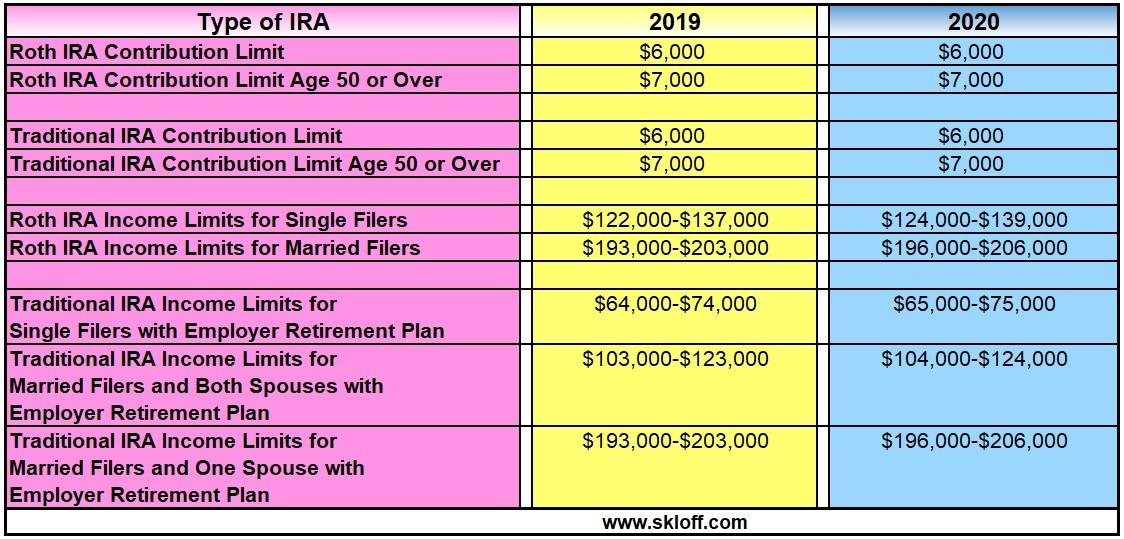

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2019 and 2020 Skloff Financial, The irs has some good news for workers who use traditional or roth iras to save for retirement.

Source: tiphaniewclovis.pages.dev

Source: tiphaniewclovis.pages.dev

Roth Ira Limits 2024 Phase Out Ibby Cecilla, The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Source: shelbkathryn.pages.dev

Source: shelbkathryn.pages.dev

Ira Limits 2024 Magi Grier Kathryn, $6,500 (for 2023) and $7,000 (for 2024) if you're under age 50.

Source: georgetawelaine.pages.dev

Source: georgetawelaine.pages.dev

Roth Ira Rules 2024 Limits Irs Annis Hyacinthie, Anyone can contribute to a traditional.

Source: goldaqbernice.pages.dev

Source: goldaqbernice.pages.dev

Roth Ira 2024 Contribution Limit Irs Wendy Joycelin, You can contribute to an ira at any age.

Source: opalysuzanne.pages.dev

Source: opalysuzanne.pages.dev

Traditional Ira Limits 2024 In India Ianthe Hyacinth, Anyone can contribute to a traditional.

Posted in 2024